Home Selling Tips

How much does it cost to sell a house?

Reading Time — 15 minutes

March 9, 2020

Reading Time — 15 minutes

March 9, 2020

Table of contents:

While the average real estate agent commission hovers around 5% to 6%, depending on where you live, the total cost of selling tends to be higher.

When you factor in additional costs that are common in most sales like repairs, closing costs, and relocating costs, your total expenses can come closer to 10% of the home’s sale price.

There can also be a substantial investment of time as you wait for the right buyer to make an offer, qualify for a mortgage, and then close the deal.

This guide gives you an overview of how much it costs to sell your home so you can choose the best way to sell that makes sense for your budget.

→ If you’re exploring different options, learn how the cost of selling to Opendoor compares to a traditional sale.

What is the cost of selling a house, in a nutshell?

Assuming you sell your house for $248,000 (the median price for a single-family home in the U.S. in 2018) you could end up paying about $38,000 in total costs. The real estate commission will be most likely the biggest fee you will pay as a seller.

See out a more detailed breakdown of our estimated home selling cost in the section at the end of this guide.

Preparing your home to sell

Before listing your home, you’ll want to ensure that it’s market-ready to attract interested buyers. There are four main costs to consider as you prep your home.

Staging costs (~1% of sale price)

When prospective buyers see your home for the first time, you want them to focus on the home’s best features while visualizing themselves living in the space. That’s where staging comes in. Staging involves arranging furniture and decor to make a home as visually appealing to buyers as possible.

According to cost comparison site Fixr, the average cost nationally to hire a professional stager ranges from $2,300 to $3,200. You may save money staging your home yourself, but you’ll have to invest the time to prepare and maintain each room.

If you’re going the do-it-yourself route, consider what you’ll need to purchase. That might include paint, new furniture or light fixtures, curtains, and decorative accessories. You may also want to rent a deep cleaner for carpets, which can cost $35 to $50 per day, or pay for professional carpet cleaning, which can cost $80 to $550 according to HomeAdvisor.

Staging can pay off when you’re ready to sell. In a National Association of Realtors (NAR) survey, 29% of sellers’ agents reported an increase of 1% to 5% in the dollar value offered by buyers. Twenty-one percent reported that staging increased the sellers’ home value by 6% to 10%.

→ Want to skip the hassle of listing, showings, and months of uncertainty? Learn how selling to Opendoor works.

Landscaping costs (~1%)

The outside of your home can be almost as important as the inside when it comes to selling. Curb appeal can entice buyers, particularly those who shop online and rely on photos to compare homes. Landscape maintenance covers things like mulching, pruning shrubs and planting flowers; standard lawn care covers weeding and fertilizing.

At the low end, landscaping can cost just a few hundred dollars if you’re doing something simple like reseeding the lawn or sprucing up your flower beds. The average cost of a more comprehensive service—flower beds, plants, trees, etc—is around $3,239, according to HomeAdvisor. This will of course depend on the size of your yard and the extent of the job.

Home repairs and maintenance (varies)

Maintenance and repair issues are one of the primary reasons why pending home sales fall through at closing. If you’re selling to Opendoor, we simplify the repair process so you have the certainty of a competitive offer and more flexibility in how you can handle needed repairs. If you’re selling the traditional way, ensuring your home is in good condition before listing can help you avoid making major concessions to the buyer when an offer is on the table.

As you prepare to sell, inspect your home for damaged features, broken appliances, and spaces that need to be cleaned or refreshed. Our home maintenance checklist will walk you through common repair items that can impact your home’s value and specifically what to look for as you inspect each area.

Getting a pre-inspection assessment can also help you pinpoint what needs to be fixed. The total cost of repairs will vary based on your home’s condition. As you list out necessary repairs, decide what you can do yourself and where you’ll need to hire professional help. Compare quotes from multiple contractors so you have a range of prices to consider.

Home improvements (varies)

Aside from repairs, consider whether you want to make any renovations to the home, what you might spend in both time and money, and the potential return on investment.

For example, kitchens are the most important space for buyers, according to a NAR survey. A minor remodel could cost you almost $21,200 on average, according to the Remodeling 2018 Cost vs. Value Report. The upside is an 81.1% recoup of the cost at the sale, but you’re investing time and energy if you’re doing a remodel yourself. Hiring professionals can save time but you might find it inconvenient or cost-prohibitive.

Focusing on smaller renovations that add value for buyers might make more sense if you don’t have as much time or money to spare. Instead of a complete kitchen overhaul, for instance, you could spend a weekend updating cabinet pulls and installing a new backsplash. Both can catch a buyer’s eye and boost your home’s value.

Negotiating the sale

Once your home is ready to list, the next step is waiting for a buyer to make an offer. After you’ve accepted an offer, you can move into the next phase of the selling process, which usually involves some back and forth negotiation between your agent and the buyer’s agent. There’s also another round of costs to weigh.

→ See our guide to selling your home fast

Real estate agent commissions (~5% to 6% of sale price)

Working with a real estate agent means they handle the selling legwork for you, such as arranging tours, scheduling paperwork, updating your listing, and arranging things like photography of the home. This saves you time, but these services aren’t free. On average, Bankrate estimates sellers pay 5% to 6% of the sale price as commission fees. For a $300,000 home, that means you’d pay $15,000 to $18,000.

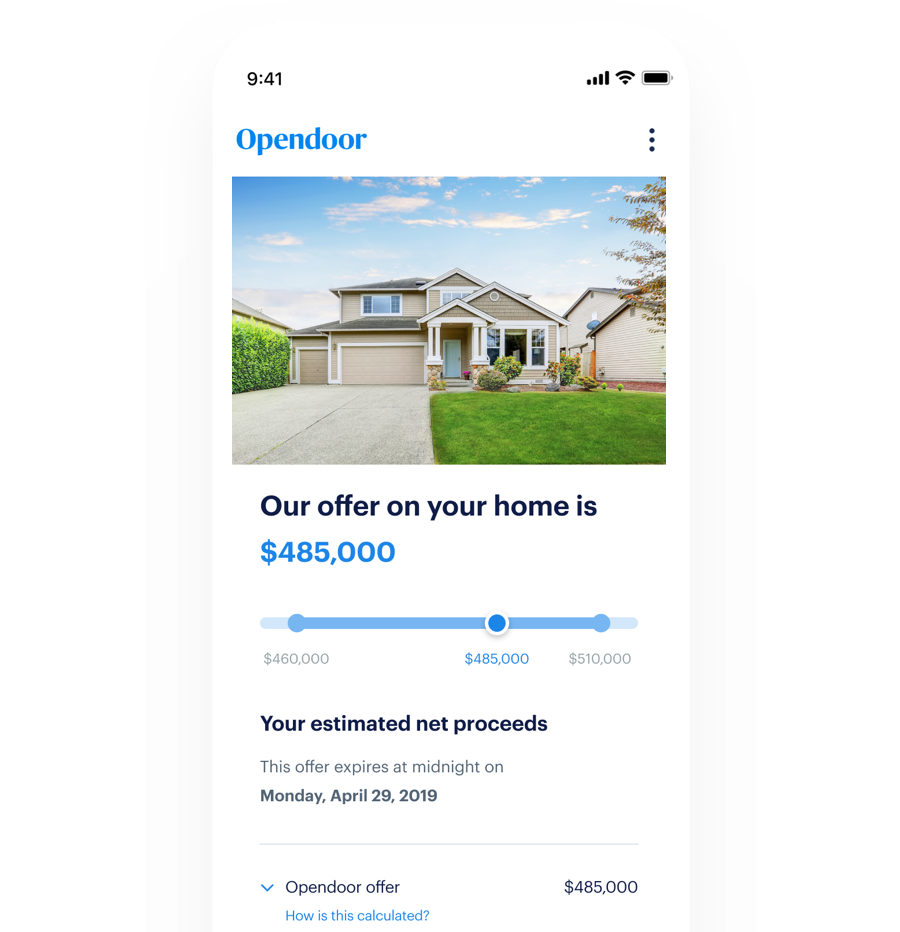

This commission is split between your agent and the buyer’s agent. If you’re selling to Opendoor, our service charge is currently 5%, which is similar to the 5-6% real estate commission that covers both the listing agent’s commission and the buyer’s agent’s commission in a traditional sale. Learn more about our pricing and how it compares to a traditional sale.

You could also fly solo and sell your home without an agent, but you still might be responsible for paying commission to the buyer’s agent, if the buyer is represented by an agent. Assuming that’s half the average fee estimated by Bankrate, you’d pay 2.5% to 3%. Considering that 87% of buyers use an agent, according to the NAR, that commission is often an unavoidable expense.

→ A cash offer from Opendoor allows a faster, more certain sale. See what we can offer for your home.

Seller concessions (~0% to 2%)

A concession means you’ve agreed to pay certain costs for the buyer, usually as a means of sweetening the deal so the buyer is more likely to close. For example, they might ask for help with inspection fees, processing fees, or other costs. A buyer might ask for a concession if they don’t have enough cash to cover their closing costs or if the home is older and they want to preserve cash to make updates. Buyers can also use concessions as a bargaining tool in a buyer’s market, or to offset the cost of having to make a higher offer to compete in a seller’s market.

The amount a buyer can request is limited by their loan type. Conventional loans adhering to Fannie Mae guidelines allow for concessions of up to 3%, 6% and 9%, based on the size of the buyer’s down payment. For FHA and VA loans, which are backed by the Federal Housing Administration and the Department of Veterans Affairs, respectively, concessions are capped at 6% and 4%, according to The Mortgage Reports.

The market you’re selling in can influence what you pay in concessions. Opendoor’s analysis of internal and public home sale data in our markets indicates that when buyers ask for concessions, they typically ask for 0% to 2% of the home sale price.

Finalizing the deal

As you approach your closing, there are still a handful of costs to plan for.

Closing costs (~1% to 3% of sale price)

Closing costs are an assortment of fees—separate from agent commissions—that are paid by both buyers and sellers at the close of a real estate transaction. We break these down in our blog on closing costs for the seller. According to Realtor.com, sellers typically pay between 1% and 3% on average at closing. If you’re hoping to sell your home for $250,000, you could potentially pay $2,500 to $7,500 in closing costs.

Closing costs are usually lower for the seller because there are fewer fees involved. Typically, the main costs you’ll pay include the closing fee, which is paid to the closing agent, property taxes, your attorney’s fee, recording fees, a transfer tax, and any costs associated with paying off your original mortgage.

Transfer Taxes

Transfer taxes apply when transferring the title of a piece of real estate from one person to another. Transfer tax can be assessed at the state, county, and municipal levels. The amount you pay depends on where the sale takes place. According to the National Conference of State Legislatures, 12 states charge no real estate transfer tax at all. Arizona charges a flat transfer fee of $2. The remaining states have transfer taxes that typically range from 0.01% to 5% of the sale price.

Mortgage payoff

Before you can officially deem a sale finished, you’ll need to pay off your mortgage. The proceeds of the sale are used to pay off your old loan, but there may be a small shortfall if the payoff amount doesn’t include prorated interest. You might have to cut a check to the lender to make up the difference.

Additionally, you may have to pay a prepayment penalty for paying off your loan ahead of schedule. Prepayment penalties are usually set at 2% to 4% of your original loan amount, according to Realtor.com.

Buyer’s home warranty (<1%)

While your homeowners insurance usually covers the structural aspects of your home in the event of damages caused by fire or certain types of natural disasters, a home warranty has a different scope. According to Realtor.com, home warranties can cover repair and/or replacement costs for kitchen appliances and the washer and dryer, as well as the electrical, plumbing, and heating and air systems.

You can offer to purchase a warranty to cover the home leading up to closing, so the buyer knows they’re not facing repair costs as soon as they sign. Or, you could offer to pay for a year or two of warranty coverage after closing. A buyer warranty can cost between $300 and $600, according to Realtor.com. It’s a nice perk to offer buyers, but it’s not a requirement.

Relocate to your new home

By now, you might think you’ve finished paying for all the costs of selling your home. But as you are preparing to relocate to your new home, remember to take the following costs into account as well.

Moving costs (~1% to 2%)

You may move before the closing or after. Three factors that influence moving costs are:

Whether you’re moving a short or long distance

The number of household items you’re moving

Whether you’re moving yourself or hiring professional movers

Hiring professional movers has its advantages. A full-service mover can handle packing your belongings, moving them to your new home, and unpacking them. You may pay a flat fee or an hourly fee for that convenience.

HomeAdvisor estimates the cost of professionally moving a three-bedroom house locally at $760 to $1,000. Movers charge more for longer distance moves and to transport heavy or bulky items, such as a piano or your kids’ swing set.

For a DIY move, renting a moving truck can cost as little as $50 or over $2,000, according to HomeAdvisor, depending on the size of the truck and the number of miles traveled. A local move could cost just a few hundred dollars when you factor in the rental fee and gas. You’ll also need to pay for boxes, tape, and other packing materials.

If you have things that need to be thrown away, you may also have to pay for either a portable dumpster that can be picked up, or to have someone haul those items away. Finally, you may need to pay deposits for electric, gas, water and trash collection at your new home.

Remember that timing matters with a move. HomeAdvisor suggests the cost of a move may be twice as high during the summer months. From May to September, demand for moving trucks and professional moving services peaks, as families often move in summer while school is out, and college students move to and from campus. Higher competition for moving services often results in higher prices.

Home transition and overlap costs (~1%)

There’s usually a transition period between selling your current home and moving into a new one. If you’ve already closed on a new place, you might pay ownership costs for two homes simultaneously. That can include both mortgages, utility costs, HOA fees, property taxes and homeowners insurance.

If you haven’t closed on the new home or you’re still searching for the right one, you’ll need to budget for temporary living arrangements. You’ll also need to pay to have your furniture and other belongings stored until you can settle permanently. According to SpareFoot, the average monthly cost of self-service storage ranges from around $66 to almost $135, based on the size of the unit. Keep in mind, in this scenario you may need to move twice, which aside from being time-consuming, can also be very expensive.

Our analysis of internal and industry data suggests that together, transition costs typically add up to about 1% of the sale price, assuming a transition period of one and a half months. One of the advantages of selling to Opendoor is we give you control of your moving timeline so you can avoid these housing overlap costs.

Key takeaways

There are typically more costs to selling a home beyond real estate agent commissions—10% of the sale price is a good place to start. Take time to calculate each of the costs listed here individually, assuming they apply to your situation. The more accurately you’re able to estimate the total amount you’ll pay, the less room there is for surprises. More importantly, you’ll have a better idea of how much you stand to walk away with, and therefore, how much you can put towards your next home.

Breaking down the costs of selling a home

In the table below, we break down common home selling costs, assuming an offer price of $248,000 – the median single-family home price in the U.S. in the fourth quarter of 2018, according to NAR.

You can see that when you take all the expenses into account, the total cost of selling reaches over 16% of the sale price. Keep in mind that these costs will vary based on the circumstances of the sale, but you can quickly see how the cost of selling extends beyond real estate agent commissions.

Home sales price | $248,000 | |

Cost item | Cost amount | % of sales price |

Home preparation | ||

Staging costs | $2,480 | 1% |

Home repairs & renovations * | $12,400 | 5% |

Negotiating the sale | ||

Real estate agent commissions | $14,880 | 6% |

Seller concessions | $1,240 | 0.5% |

Finalizing the deal | ||

Closing costs ** | $2,480 | 1% |

Relocation | ||

Transition and overlap costs | $2,480 | 1% |

Moving costs | $2,480 | 1% |

Total costs | $38,440 | 15.5% |

Estimated proceeds | $209,560 |

*For repair costs, we took the national average in 2018 according to homeadvisor.com.

**Includes estimated cost of title, escrow, notary, and the transfer tax

Rebecca Lake

This article is meant for informational purposes only and is not intended to be construed as financial, tax, legal, real estate, insurance, or investment advice. Opendoor always encourages you to reach out to an advisor regarding your own situation.